Data Management Services

Get more value from your data

Bloomberg Data Management Services enables firms to streamline the acquisition, management and distribution of Bloomberg entity, instrument, markets and pricing data from multiple delivery channels.

Bloomberg Data Management Services (DMS) is an owned subsidiary of Bloomberg, offering two primary solutions: Data License Plus (DL+) and Data License Plus ESG Manager (DL+ ESG Manager).

Cloud-based solution

Aggregate, organize and link your data to maximize value, reduce your total cost of ownership and accelerate your cloud journey.

Centralized workstation

View, navigate, customize and interrogate licensed datasets from one centralized place.

Data License Plus

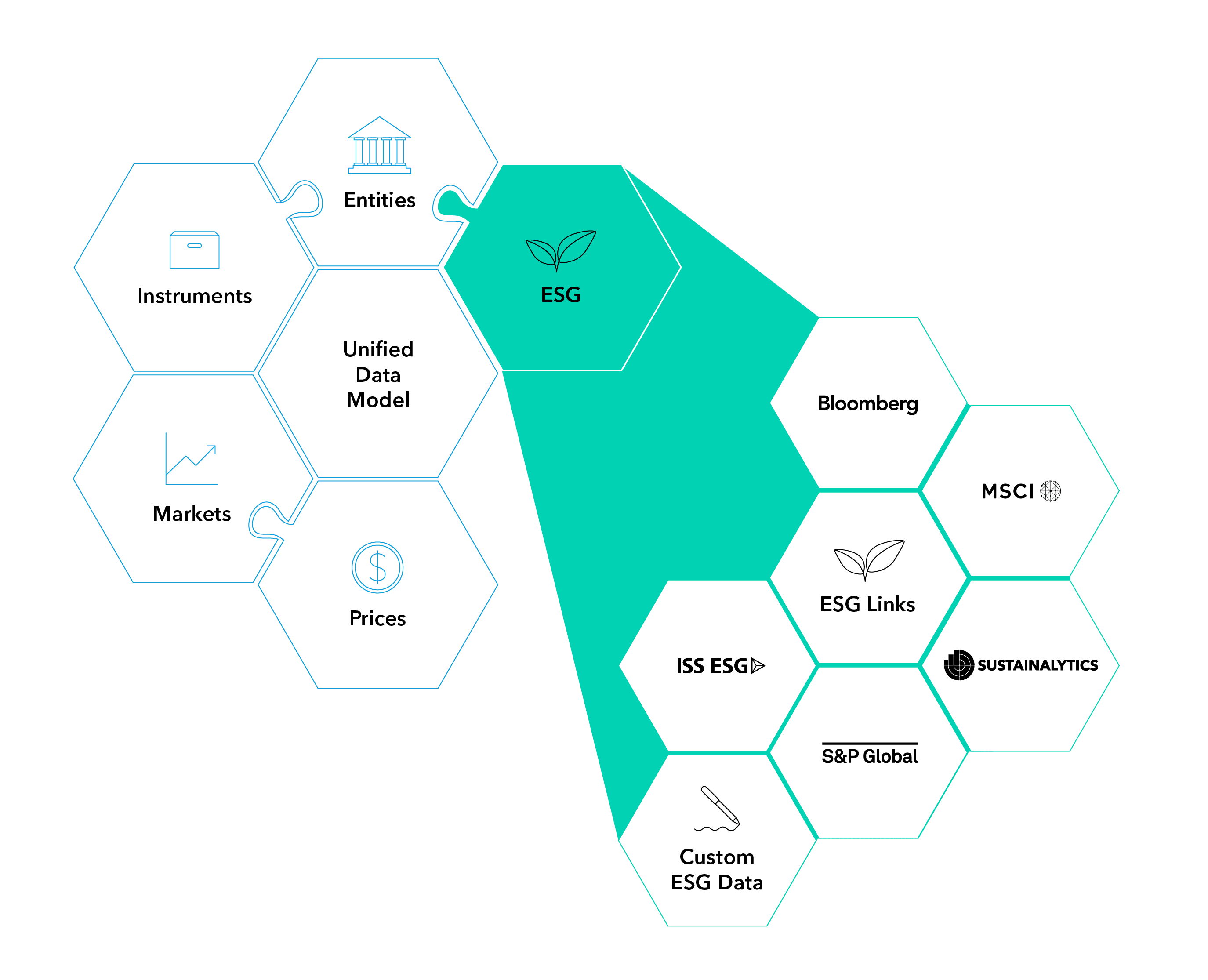

Data License Plus (DL+) is a privately hosted, cloud-based data management solution that aggregates, organizes and links your licensed Bloomberg data from multiple delivery channels. It delivers the data to your applications and data warehouses in a consistent, transparent, controlled unified data model through a diverse set of collection technologies.

Transparency

See where data is coming from by investigating and searching through the intuitive, web-based workstation and tracing data back to source files.

Control

Stay in control of your data by managing data access, field selection, and refreshing scheduling using self-service configuration screens.

Accessible

Distribute consistent data to consuming enterprise applications in a multitude of ways: Per Security SFTP, REST API or delivered directly in table-ready format to your cloud data warehouse.

Managed

Offload in-house data processing efforts by shifting the lift of requesting, acquiring, refreshing and synchronizing Bloomberg data to DL+.

Navigable

Discover new data points by navigating linked datasets that connect legal entities, securities, the markets they trade in and prices.

Scalable

Feed your applications of today while building out your future target operating model, all from DL+.

Data License Plus ESG Manager

Data License Plus ESG Manager (DL+ ESG Manager) offers all the benefits of DL+ as well as the ability to outsource your multi-vendor ID mapping and change management challenges, vendor by vendor. Whether you need to feed your existing legacy and third-party applications or your cloud data warehouse, DL+ ESG Manager has what you need.

Multi-vendor access

Manage multi-vendor ESG data pipelines and provide expanded ESG coverage throughout your entity and security master universe. DL+ ESG Manager processes data available through our vendor partners including MSCI, S&P Global, Sustainalytics and more.

Diverse collection technologies

Take the data from DL+ ESG Manager that has been collected and organized and easily connect to other services such as B-PIPE, Data License and more.

Interoperability

With DL+ ESG Manager, diverse operational datasets are accounted for, linked and connected for streamlined operations.

Expanded coverage of existing ESG vendor data

DL+ ESG Manager cascades coverage throughout your corporate hierarchy to entities and instruments accounting for gaps in universe coverage.

Managed change control

DL+ ESG Manager takes on the burden of managing never-ending vendor change requests to data and data models.

Explore Bloomberg Data Management Solutions

Seamlessly integrate data across your firm.